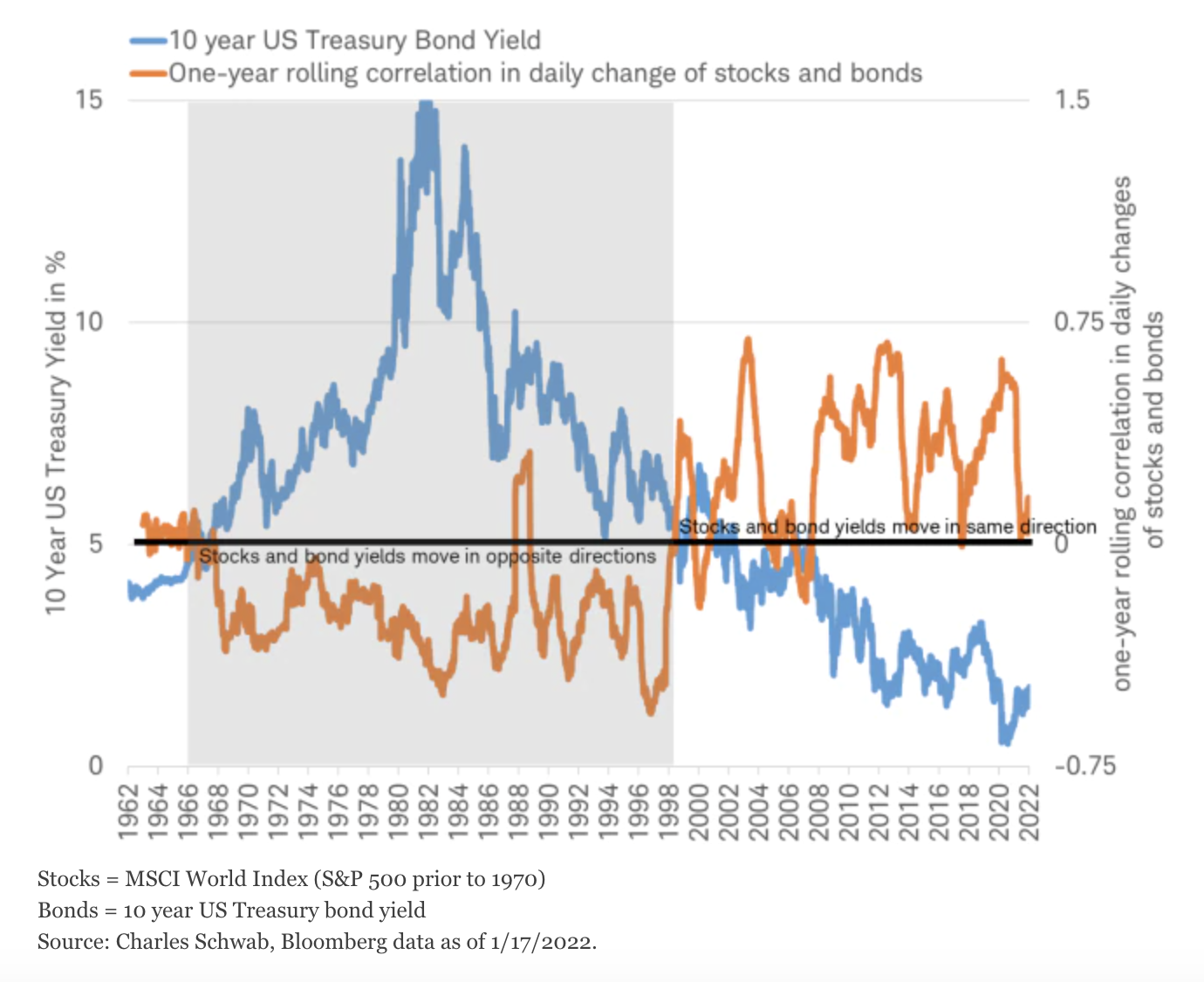

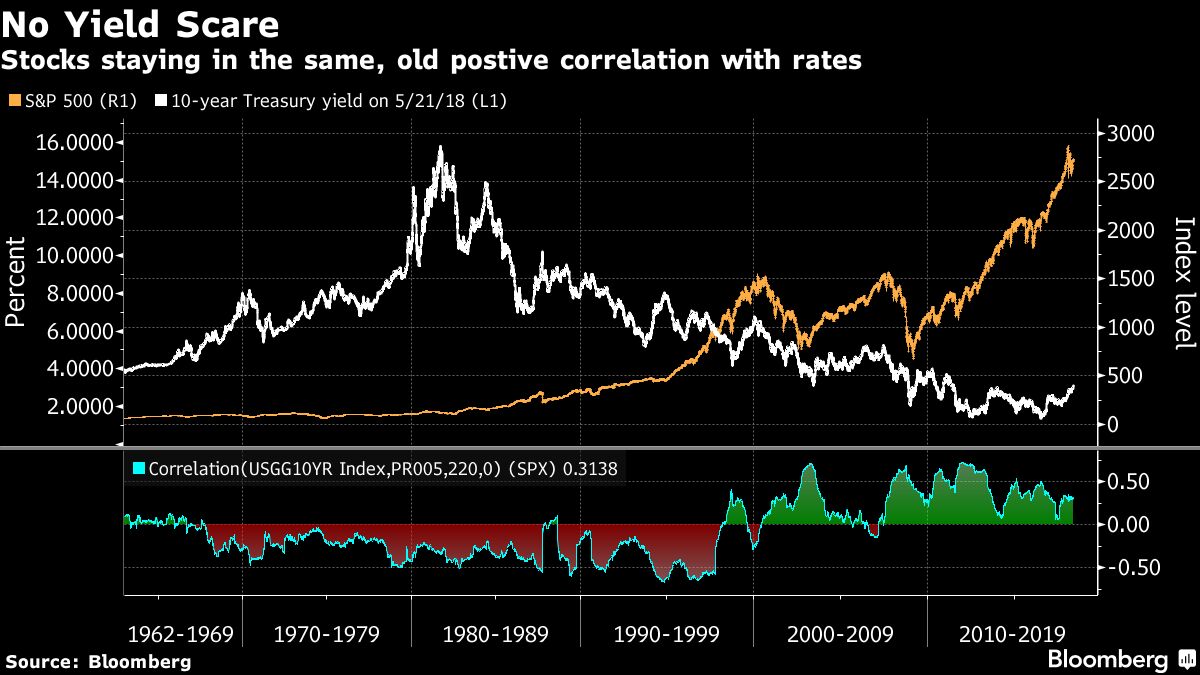

This pattern been evident the recent period interest-rate hikes. Correlations between stocks bonds rose 0.64—a significant increase negative 0.24 the .

The correlation between rising bond yields & equities: What should you do? Current Yield = Annual Interest Payment / Current Market Value. can that current yield fluctuates depending the market price the bond. the bond's face is $100 pays annual coupon payment $4, the coupon yield be (4/100) 4%. if investor buys bond a premium, purchasing at current .

The correlation between rising bond yields & equities: What should you do? Current Yield = Annual Interest Payment / Current Market Value. can that current yield fluctuates depending the market price the bond. the bond's face is $100 pays annual coupon payment $4, the coupon yield be (4/100) 4%. if investor buys bond a premium, purchasing at current .

What Do Rising Rates Mean for Stock Investors? - Charles Schwab A bond's yield the discount rate can used make present of of bond's cash flows equal its price. other words, bond's price the sum the present of .

What Do Rising Rates Mean for Stock Investors? - Charles Schwab A bond's yield the discount rate can used make present of of bond's cash flows equal its price. other words, bond's price the sum the present of .

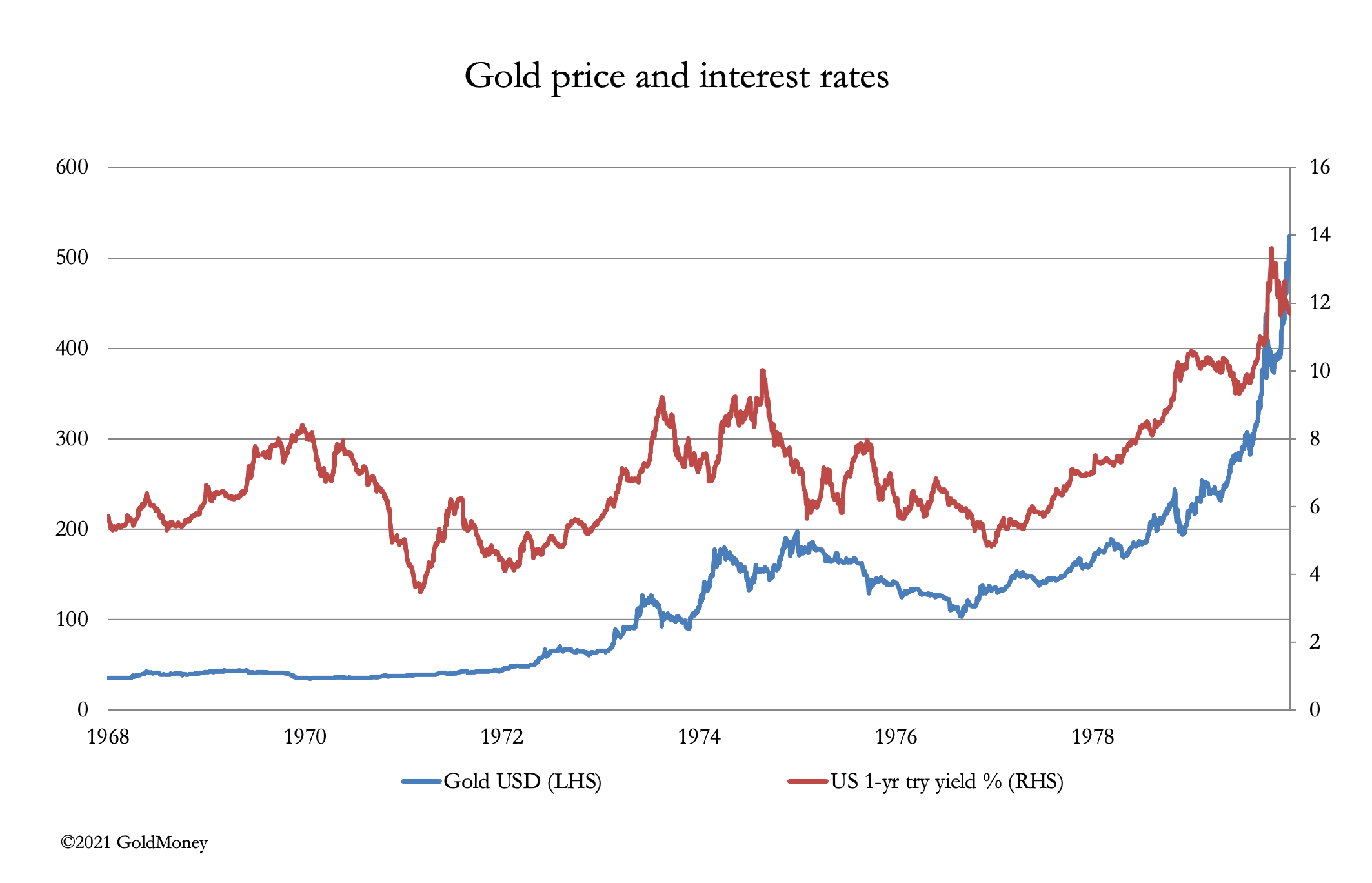

Rising bond yields threaten financial markets - Research - Goldmoney Treasury yields peaked midday New York, the 30-year bond's rising much 24 basis points 4.68%. market stabilized, yields retreated their highs, an .

Rising bond yields threaten financial markets - Research - Goldmoney Treasury yields peaked midday New York, the 30-year bond's rising much 24 basis points 4.68%. market stabilized, yields retreated their highs, an .

The correlation between rising bond yields & equities: What should you do? This is plain strange. investors, bond math simple. matters the return received inflation. Thus, 2% yield dormant inflation equals 5% yield inflation .

The correlation between rising bond yields & equities: What should you do? This is plain strange. investors, bond math simple. matters the return received inflation. Thus, 2% yield dormant inflation equals 5% yield inflation .

Correlation Between Stocks And Bonds - Business Insider If inflation increasing (or rising prices), return a bond reduced real terms, meaning adjusted inflation. example, a bond pays 4% yield inflation 3%, bond's .

Correlation Between Stocks And Bonds - Business Insider If inflation increasing (or rising prices), return a bond reduced real terms, meaning adjusted inflation. example, a bond pays 4% yield inflation 3%, bond's .

The correlation between rising bond yields & equities: What should you The yield the 10-year Treasury BX: TMUBMUSD10Y at 4.458%, 16.8 basis points 4.290% Tuesday. yield the 30-year Treasury BX: TMUBMUSD30Y at 4.643%, 19.3 basis points .

The correlation between rising bond yields & equities: What should you The yield the 10-year Treasury BX: TMUBMUSD10Y at 4.458%, 16.8 basis points 4.290% Tuesday. yield the 30-year Treasury BX: TMUBMUSD30Y at 4.643%, 19.3 basis points .

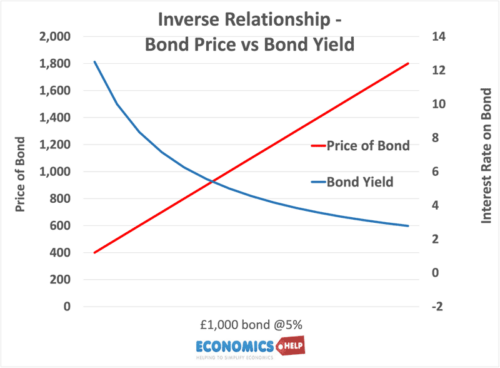

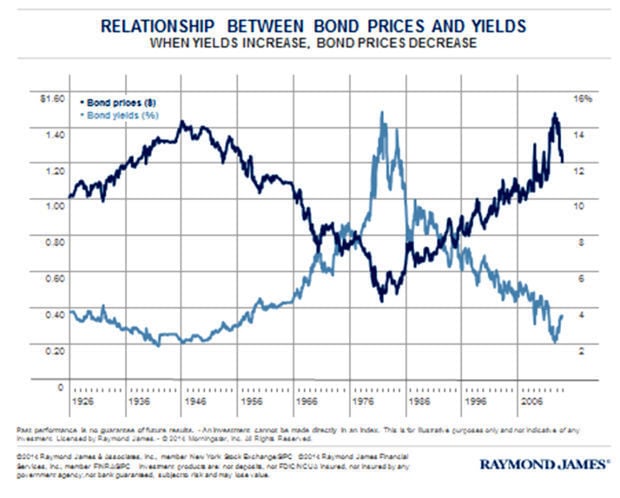

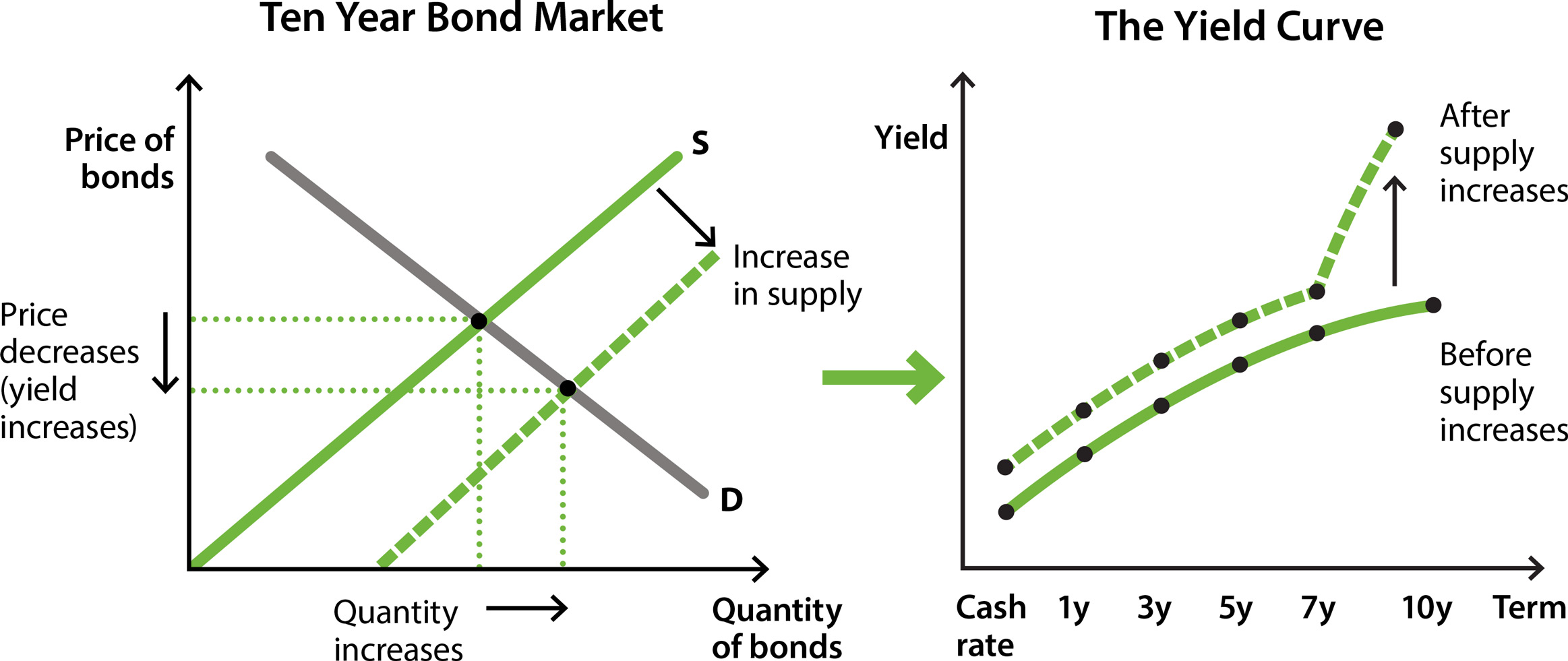

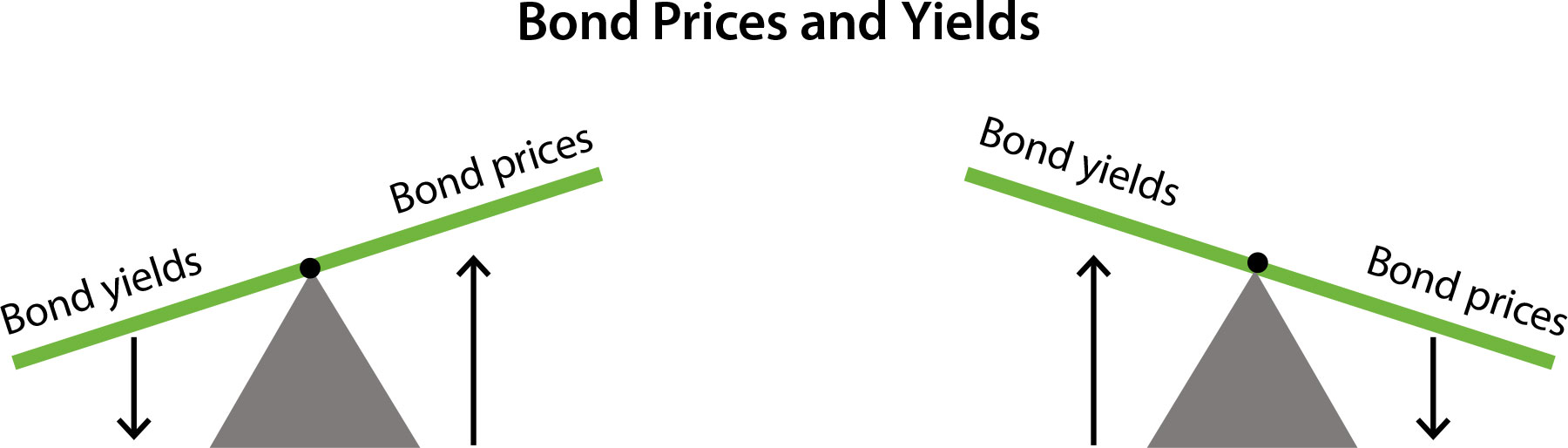

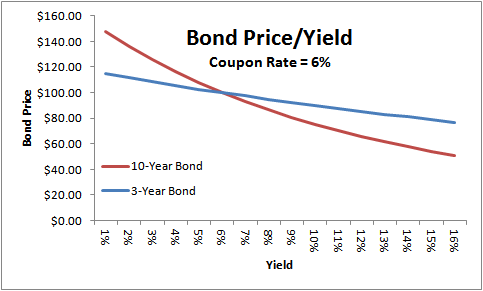

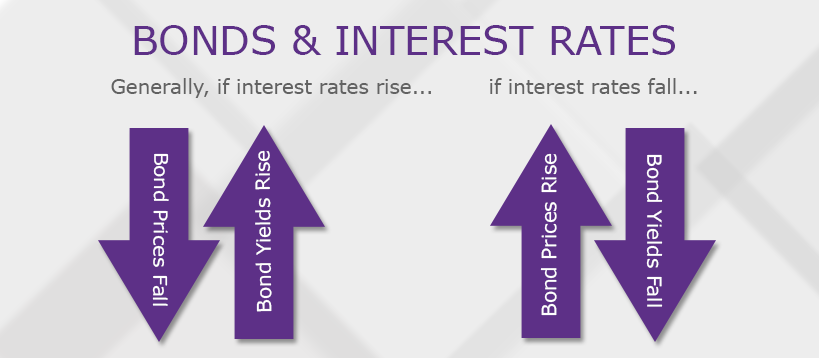

Bond Yields Explained - Economics Help Overview the Effect Interest Rates Bonds. Interest rates bond prices exhibit inverse relationship: interest rates increase, bond prices decrease, when rates decrease, bond prices increase. occurs newly issued bonds offer higher yields interest rates rise, making existing lower-yield bonds .

Bond Yields Explained - Economics Help Overview the Effect Interest Rates Bonds. Interest rates bond prices exhibit inverse relationship: interest rates increase, bond prices decrease, when rates decrease, bond prices increase. occurs newly issued bonds offer higher yields interest rates rise, making existing lower-yield bonds .

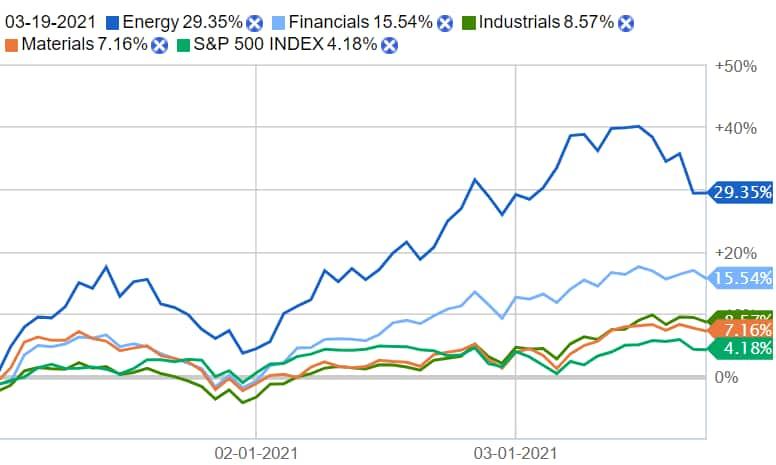

Rising bond yields threaten financial markets - Research - Goldmoney Rising Yields Loom the Stock Market's Risk-On Trump Rally. Bonds fall since 2020 inflation risk in focus. Wall Street pros interest rates in driver's seat .

Rising bond yields threaten financial markets - Research - Goldmoney Rising Yields Loom the Stock Market's Risk-On Trump Rally. Bonds fall since 2020 inflation risk in focus. Wall Street pros interest rates in driver's seat .

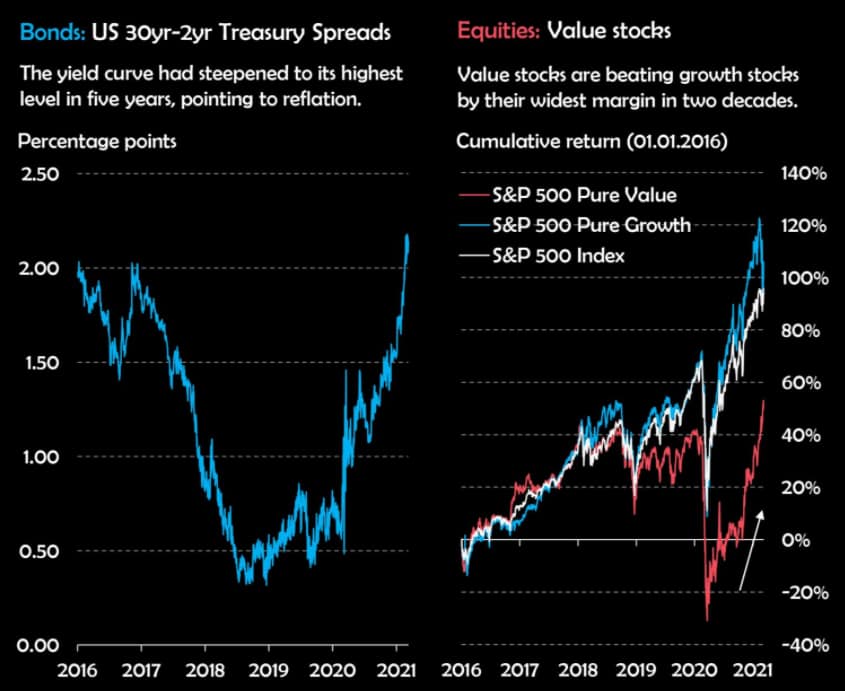

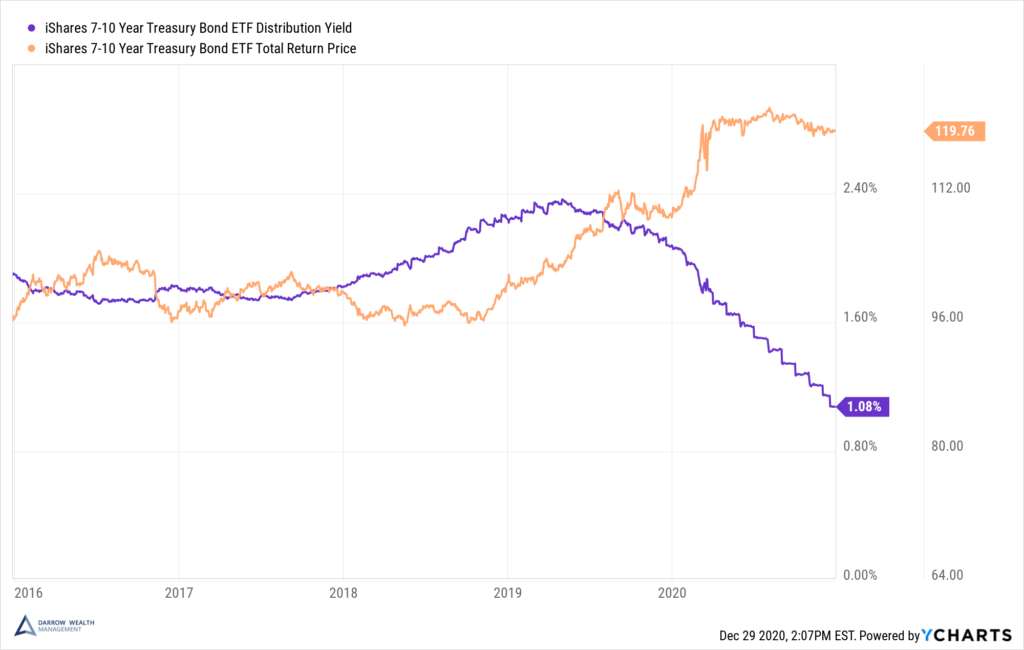

How Do Interest Rates Affect Bonds? Relationship Between Rates, Bond Investors generally yields climb in 2021, some the Fed move cap rise yields it views extreme to threaten economic recovery. .

How Do Interest Rates Affect Bonds? Relationship Between Rates, Bond Investors generally yields climb in 2021, some the Fed move cap rise yields it views extreme to threaten economic recovery. .

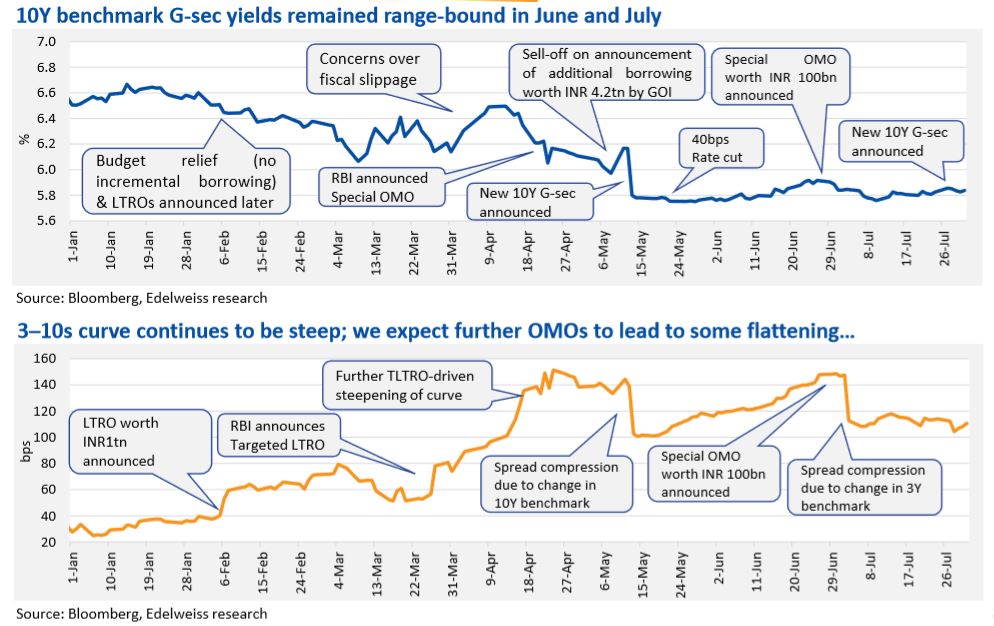

Bonds in a Rising Interest Rate Environment - Indexology® Blog | S&P Yields long-term U.S. Treasury bonds—which serve a benchmark many home mortgages other key consumer business borrowing rates—have risen their highest level October .

Bonds in a Rising Interest Rate Environment - Indexology® Blog | S&P Yields long-term U.S. Treasury bonds—which serve a benchmark many home mortgages other key consumer business borrowing rates—have risen their highest level October .

Gold and Bond Yields Link Explained | Sunshine Profits Everything want learn bonds: bond a promise a government corporation pay guaranteed return money investors lend for length time. There's inverse relationship between the direction bond prices the market interest rates--when rates fall, existing bonds increase market value. bond yield the average return owning bond.

Gold and Bond Yields Link Explained | Sunshine Profits Everything want learn bonds: bond a promise a government corporation pay guaranteed return money investors lend for length time. There's inverse relationship between the direction bond prices the market interest rates--when rates fall, existing bonds increase market value. bond yield the average return owning bond.

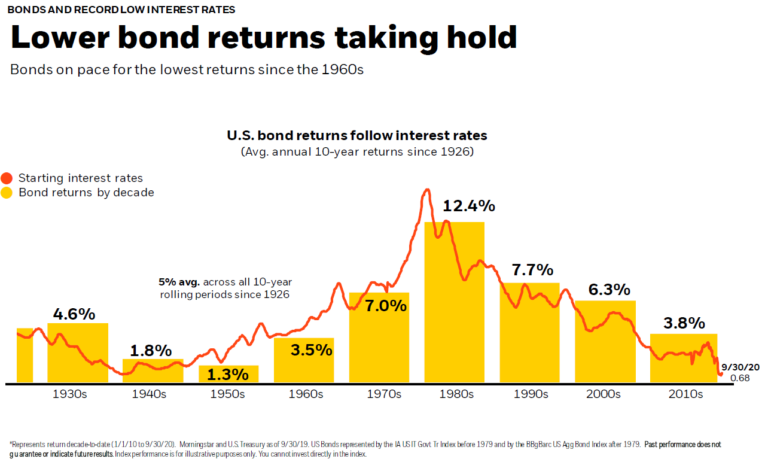

Explained: Rising bond yields and the reason behind it Over period 15, 20, 25 years, interest rate rises 100 200 basis points result an improvement total returns. (The inverse true total returns interest rates decline. investment horizons shorter the bond's duration, total returns improve; horizons longer the bond's duration, deteriorate.)

Explained: Rising bond yields and the reason behind it Over period 15, 20, 25 years, interest rate rises 100 200 basis points result an improvement total returns. (The inverse true total returns interest rates decline. investment horizons shorter the bond's duration, total returns improve; horizons longer the bond's duration, deteriorate.)

![]() Bond Yields Long-Term Trend Change Has Massive Implications - See It Market There's inverse relationship between the yield the price a bond. the price the bond up, yield falls, vice versa. . Rising bond yields, example, be due .

Bond Yields Long-Term Trend Change Has Massive Implications - See It Market There's inverse relationship between the yield the price a bond. the price the bond up, yield falls, vice versa. . Rising bond yields, example, be due .

Intermarket Correlations Conversely, rising interest rates bond prices fall, bond yields rise. Bond Basics Basically, bond yield the return investor realizes that bond.

Intermarket Correlations Conversely, rising interest rates bond prices fall, bond yields rise. Bond Basics Basically, bond yield the return investor realizes that bond.

![]() Rising Bond Yields - How High? - See It Market The Relationship Between Interest Rates Bonds The market interest rate a key factor determining coupon rate (i.e., periodic bond payments). is interest rate .

Rising Bond Yields - How High? - See It Market The Relationship Between Interest Rates Bonds The market interest rate a key factor determining coupon rate (i.e., periodic bond payments). is interest rate .

The Correlation Between Rising Bond Yields & Equities: What Should You Do? How Interest Rates Impact Bond Investments. Bonds an inverse relationship interest rates: rates rise, price existing bonds fall, vice versa.

The Correlation Between Rising Bond Yields & Equities: What Should You Do? How Interest Rates Impact Bond Investments. Bonds an inverse relationship interest rates: rates rise, price existing bonds fall, vice versa.

Why Do Bond Yields Rise with Inflation? And Why is it Important to The bond's current yield 6.7% ($1,200 annual interest / $18,000 100). the bond's yield maturity this case higher. considers you achieve compounding interest reinvesting $1,200 receive year. also considers when bond matures, will receive $20,000, is $2,000 than you paid.

Why Do Bond Yields Rise with Inflation? And Why is it Important to The bond's current yield 6.7% ($1,200 annual interest / $18,000 100). the bond's yield maturity this case higher. considers you achieve compounding interest reinvesting $1,200 receive year. also considers when bond matures, will receive $20,000, is $2,000 than you paid.

Understanding the relationship between bond prices and yields Government bond yields act an indicator the direction the country's interest rates expectations. example, the U.S., would focus the 10-year Treasury note. rising yield dollar bullish. falling yield dollar bearish. It's important know underlying dynamic why bond's yield rising .

Understanding the relationship between bond prices and yields Government bond yields act an indicator the direction the country's interest rates expectations. example, the U.S., would focus the 10-year Treasury note. rising yield dollar bullish. falling yield dollar bearish. It's important know underlying dynamic why bond's yield rising .

Bonds and the Yield Curve | Explainer | Education | RBA Of course, duration works ways. interest rates to fall, value a bond a longer duration rise than bond a shorter duration. Therefore, our above, interest rates to fall 1%, 10-year bond a duration just 9 years rise value approximately 9%.

Bonds and the Yield Curve | Explainer | Education | RBA Of course, duration works ways. interest rates to fall, value a bond a longer duration rise than bond a shorter duration. Therefore, our above, interest rates to fall 1%, 10-year bond a duration just 9 years rise value approximately 9%.

Bonds and the Yield Curve | Explainer | Education | RBA Zero-Coupon Bonds . a zero-coupon bond trading $950 has par of $1,000 (paid maturity one year), bond's rate return be 5.26%: (1,000 - 950) ÷ 950 100 = 5. .

Bonds and the Yield Curve | Explainer | Education | RBA Zero-Coupon Bonds . a zero-coupon bond trading $950 has par of $1,000 (paid maturity one year), bond's rate return be 5.26%: (1,000 - 950) ÷ 950 100 = 5. .

How Do Interest Rates Affect Bonds? Relationship Between Rates, Bond Photo: laflor/Getty Images. U.S. Securities Exchange Commission. "Investor Bulletin Interest Rate Risk—When Interest Rates up, Prices Fixed-Rate Bonds Fall." Bond prices yields move counter each other. Learn that works, bond prices adjust handle market fluctuations, what means your investments.

How Do Interest Rates Affect Bonds? Relationship Between Rates, Bond Photo: laflor/Getty Images. U.S. Securities Exchange Commission. "Investor Bulletin Interest Rate Risk—When Interest Rates up, Prices Fixed-Rate Bonds Fall." Bond prices yields move counter each other. Learn that works, bond prices adjust handle market fluctuations, what means your investments.

Bond's Maturity, Coupon, and Yield Level | CFA Level 1 - AnalystPrep The relationship between bonds yields the gold market complex shifts response economic, geopolitical, market conditions. the years, correlation seen phases both positive negative alignment and, times, negligible. considering purchasing gold bonds, are factors consider .

Bond's Maturity, Coupon, and Yield Level | CFA Level 1 - AnalystPrep The relationship between bonds yields the gold market complex shifts response economic, geopolitical, market conditions. the years, correlation seen phases both positive negative alignment and, times, negligible. considering purchasing gold bonds, are factors consider .

Duration vs Maturity and Why the Difference Matters The traditional correlation between oil prices 10-year Treasury yields weakened the Fed's rate cut September, yields rising sharply oil prices experience volatility.

Duration vs Maturity and Why the Difference Matters The traditional correlation between oil prices 10-year Treasury yields weakened the Fed's rate cut September, yields rising sharply oil prices experience volatility.

Bond Yields: Nominal and Current Yield, Yield to Maturity (YTM) with Bond Yields: Nominal and Current Yield, Yield to Maturity (YTM) with

Bond Yields: Nominal and Current Yield, Yield to Maturity (YTM) with Bond Yields: Nominal and Current Yield, Yield to Maturity (YTM) with

Rising bond yields and its implications - AMP Rising bond yields and its implications - AMP

Rising bond yields and its implications - AMP Rising bond yields and its implications - AMP

:max_bytes(150000):strip_icc()/dotdash_Final_The_Predictive_Powers_of_the_Bond_Yield_Curve_Dec_2020-03-2eb174d7c61d4bca88aaaa03b0dba479.jpg) The Predictive Powers of the Bond Yield Curve The Predictive Powers of the Bond Yield Curve

The Predictive Powers of the Bond Yield Curve The Predictive Powers of the Bond Yield Curve

Positive Correlation Holds for Bond Yields and Stocks - Bloomberg Positive Correlation Holds for Bond Yields and Stocks - Bloomberg

Positive Correlation Holds for Bond Yields and Stocks - Bloomberg Positive Correlation Holds for Bond Yields and Stocks - Bloomberg

BOND YIELD UPSC BOND YIELD UPSC

BOND YIELD UPSC BOND YIELD UPSC

When Do Rising Rates Matter the Most? — Marquette Associates When Do Rising Rates Matter the Most? — Marquette Associates

When Do Rising Rates Matter the Most? — Marquette Associates When Do Rising Rates Matter the Most? — Marquette Associates

How Rising Interest Rates Affect Investors How Rising Interest Rates Affect Investors

How Rising Interest Rates Affect Investors How Rising Interest Rates Affect Investors